How to View Your IRS Tax Payments Online

Nov 18, 2022

Did you know that you can view up to 5 years of your IRS tax payments online in one convenient place?

Here’s how:

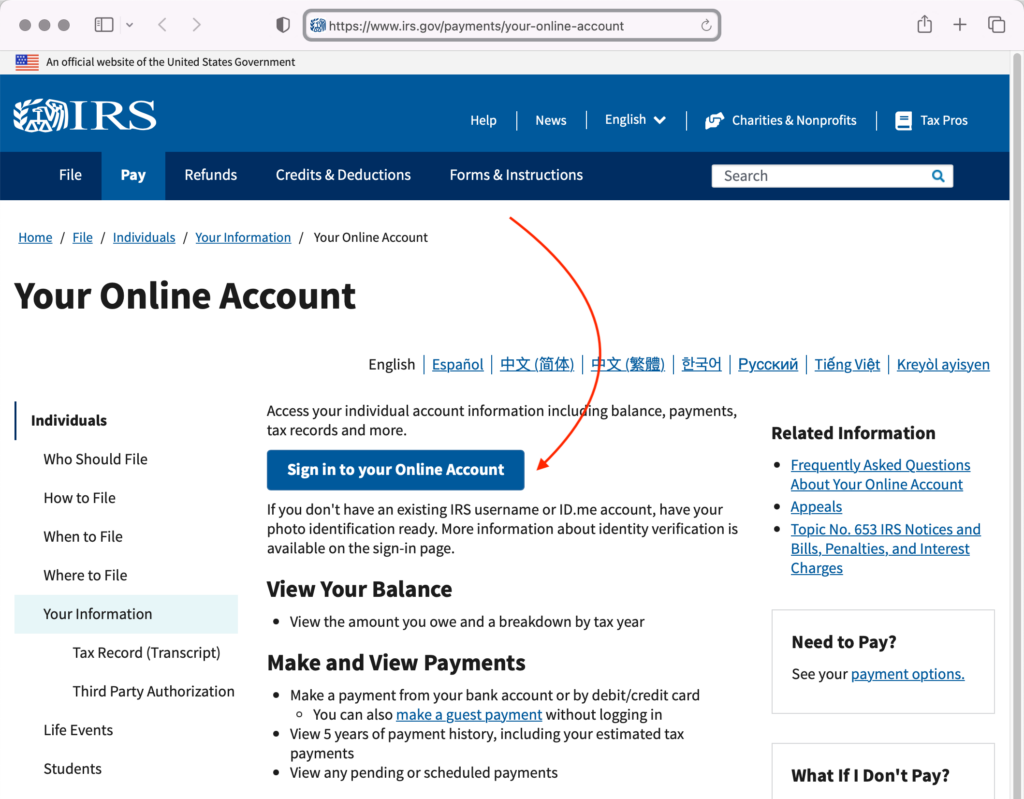

1. Go to this website to access your IRS Online Account

This is the IRS’ website specifically for individuals to access their tax records (think of it as your personal IRS hub!).

If you are looking for records of your business’ tax payments (and this would generally only apply to payroll tax deposits or corporation taxes if you are a C-Corp), you’d use your EFTPS login.

2. Click “Sign in to your Online Account”

This button will start the process of getting you logged into your IRS Online Account to view your tax payment activity.

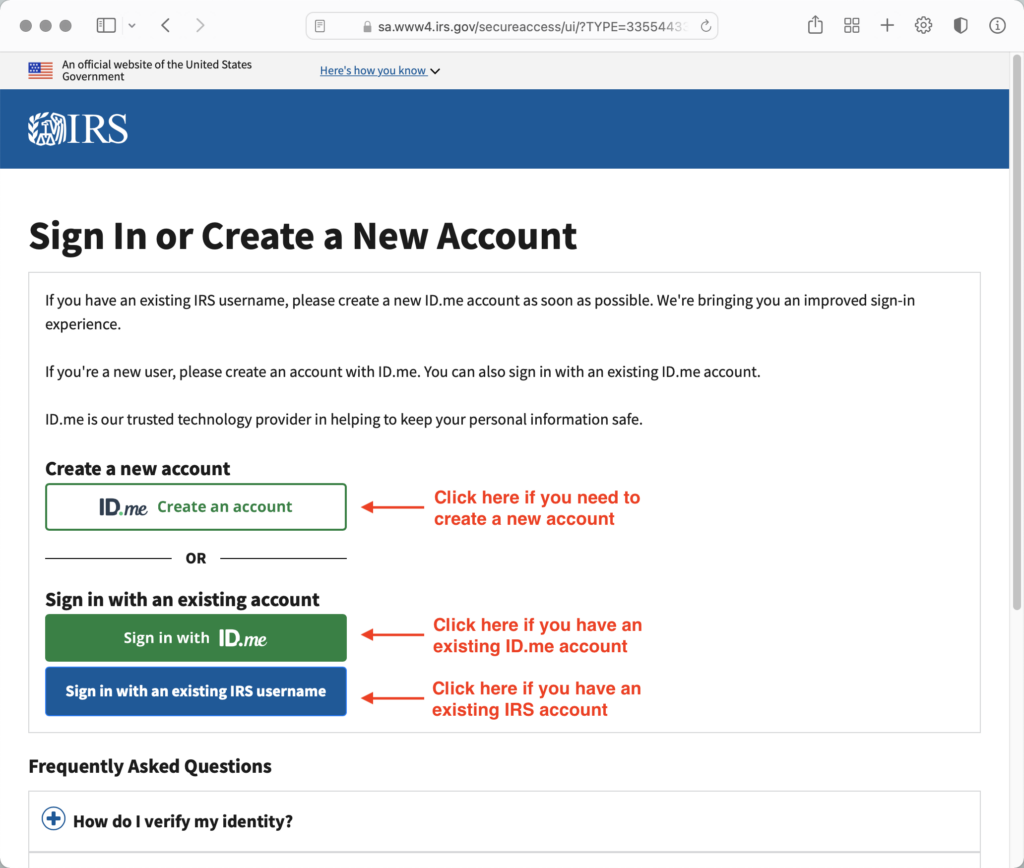

3. Create an account if you don’t have one or log in if you do have one

So, we’re not gonna lie, but this is where things can get a little tricky. If you don’t already have an IRS account you will need to create one before you can view your payment history, which includes authenticating yourself.

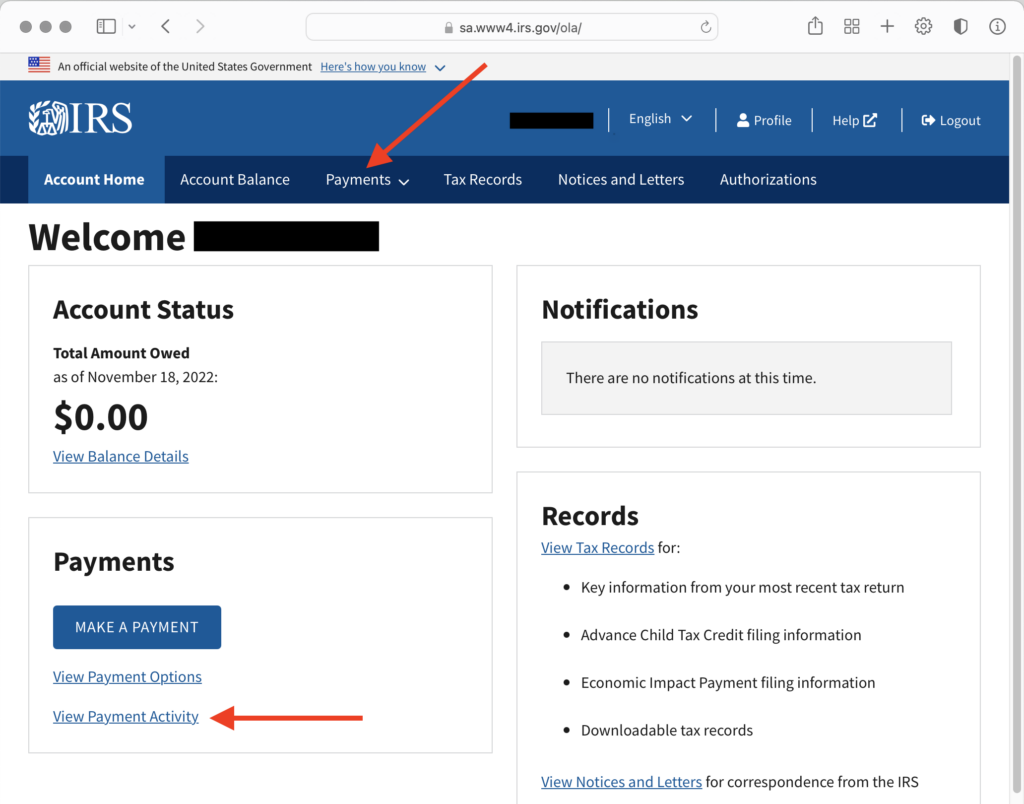

4. Click on the “Payments” tab in the navigation menu

Once you gain access to your ~magical~ IRS account, you have two ways to access your payment activity:

- Click on the “Payments” tab and select “Payment Activity”

- Click on “View Payment Activity” under the “Make a Payment” box

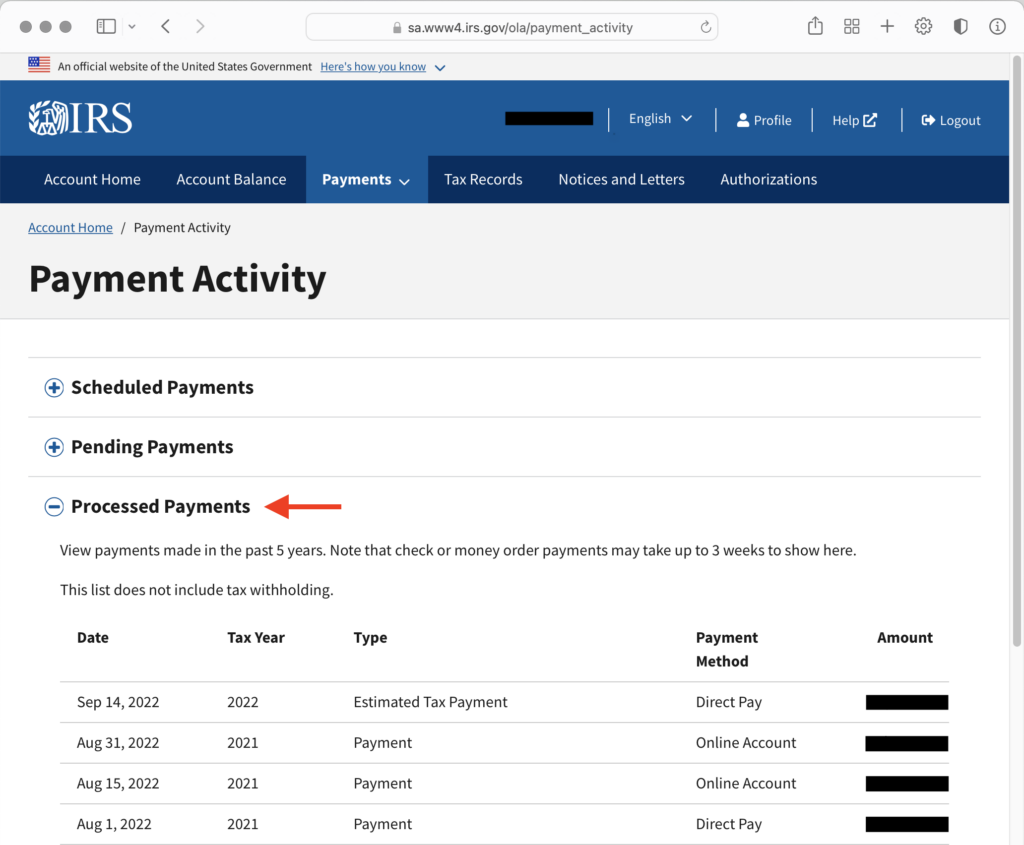

5. From here, you can see your payment activity and print/screenshot it for your records

The IRS even tells you which tax year and type the payment was for.

Questions?

Please reach out, we’d love to help!

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Countless assumes no liability for actions taken in reliance upon the information contained herein.